Important Inclusions of the 1099 Checklist The 1099 checklist contains the following points that are important to be included when filing 1099 online Personal Information It is necessary for the IRS to have a basic understanding of the individual filing taxes and the one who is covered in the tax return This can be done by using the dates of Forms 1099 and W2 are two separate tax forms for two types of workers Independent contractors use a 1099 form, and employees use a W2 For W2 employees, all payroll taxes are deducted automatically from the paycheck and paid to the government by the employer Contractors are responsible for paying their own payroll taxes and submitting them to4 status However, if the worker hires and supervises others under a contract pursuant to which the worker agrees to provide material and labor and is only responsible for the

Galachoruses Org Sites Default Files Irs Questions W2 Vs 1099 Pdf

1099 preparation checklist

1099 preparation checklist-For the W2/1099 penalty rates, clickHours MondayFriday 9 am 5 pm Other hours by appointment only Telephone Fax 9577 Email alliedaccounting@varshockcpacom Address 47 N 7 Mile Rd Midland, MI Welcome About Us News & Publications > Resources > Links

Tax Preparation Checklist By Mdconceptsllc Issuu

1099MISC Form No Comment on Your LastMinute Checklist for W2/1099 Filing A checklist will help you stay on track and ensures you never miss anything important when filing Make sure you check the list given below, before you transmit your forms and avoid penalties It's okay to file earlier but never late Be sure of your filingEmployees of a business receive a Form W2 at yearend, not a 1099MISC In addition, for our customers who have their own software and teams, we can help with this quick yearend checklist 1099 Form Additions & Changes Prepare for these changes to ensure the following 1099NEC – 1099MISC Box 7 has been replaced by the 1099NEC and is due to the IRS on 1099MISC – This form is similar to prior years, but it is

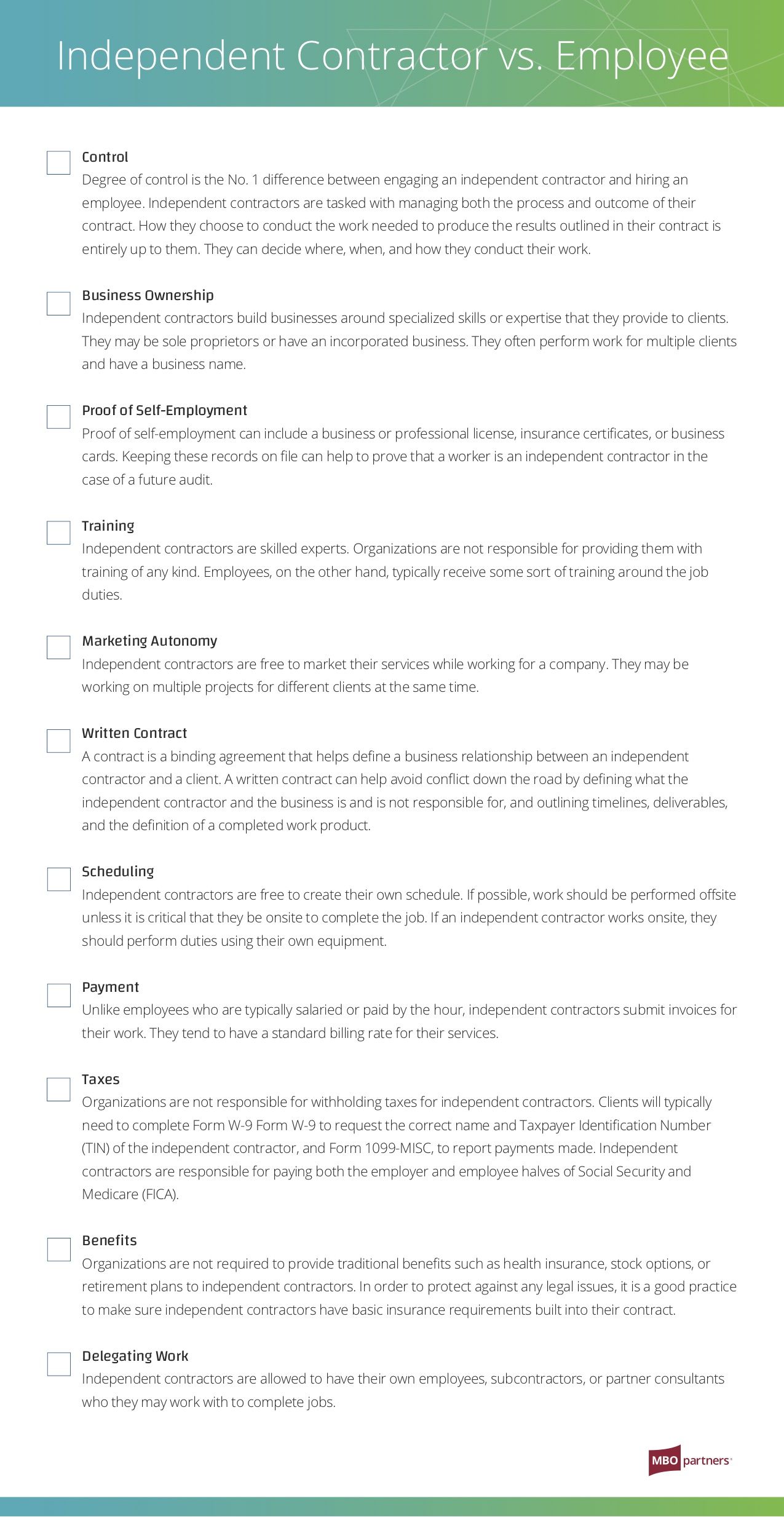

The IRS has established a point checklist the can be used as a guideline in determining whether or not a contractor can legally be paid on a 1099 This checklist helps determine who has the "right of control" Does the As an artist and a business owner, you are likely aware several accounting tasks need to be done at the end of the year Maybe you need to start tracking down those missing receipts or find that missing invoice All these things help you haveNever miss giving any necessary information ;

Install the Latest Version of the Software The software adheres to all IRS guidelines and filing1 Onboarding Process for 1099 Employees 1099 Onboarding Process –Responsibilities of "Company Name" & 1099 Hiring Manager Responsibilities 1 Hiring Manager responsible for sending a completed1099 Employee Requisition along with a Résumé to HR at hr@yourcompancom wi th a copy to joe@yourcompcom in order to process quickly The Requisition includes the followingNote Use this checklist if you are closing your fiscal year and your calendar year at the same time Post all transactions for the year Print the Aged Trial Balance with Options report Print the Vendor Period Analysis Report Install the Payroll yearend update (optional) Make a backup that is named "Pre1099 Edits" Verify the 1099 information and edit it if it is required Print the 1099

Www Kbcpas Net Uploads 1 3 7 8 Individual Checklist Taxes Pdf

2

The Amazing 1099 Checklist for Preparing Your Federal Taxes as an Independent Contractor Working for yourself can often be a satisfying and liberating experience when compared to working as a traditional employee You can usually keep your own hours and have the freedom to accept or reject work for any reason you chooseAnswer 1099 employee rules depend onTiempo de lectura 2 minutos;

1099 Employees Everything Employers Should Know Vensurehr Blog

Theskimm Freelancers Need To Collect A 1099 From Each Facebook

DPN 1099 CHECKLIST 1 GETTING STARTED Review the Company Name, Address, EIN, and, Transmitter Control Code in the Transmitter Control Code File for accuracy, prior to printing 1099 forms (AP1011 and SS1F4) The IRS requires a telephone number Ensure that the Return Address to be printed on the 1099NEC, 1099MISC, and 1099INT forms is set up in The 1099 Tax Preparation Checklist Careful planning will help you be prepared and not tearing your hair out when tax season arrives Use this checklist to make sure you cover all the bases when it comes to your 1099 taxes Keep clean records of all the income you received (this include cash, tips and value of goods received)2 Financial Are the business aspects of the worker's job controlled by the

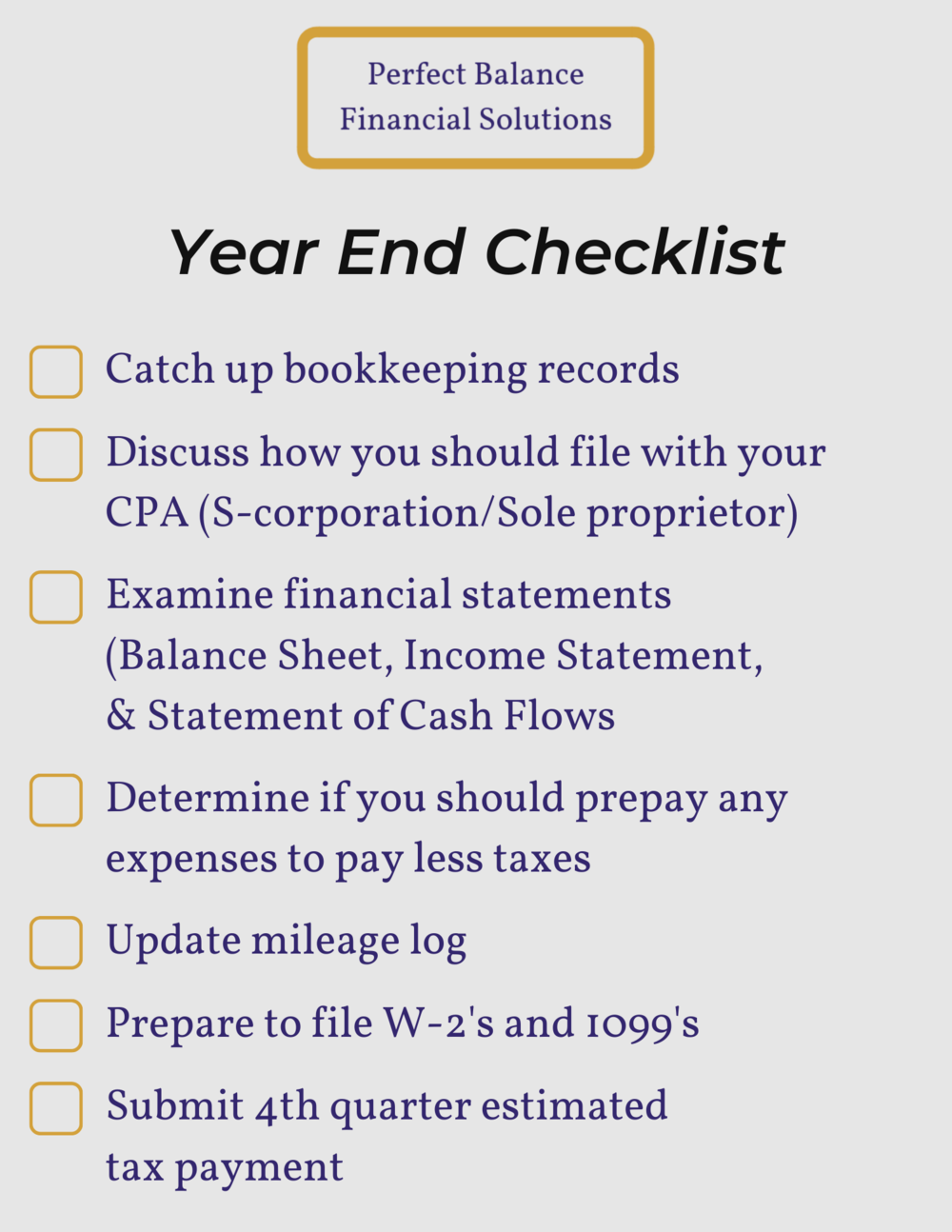

Year End Checklist Perfect Balance Financial Solutions

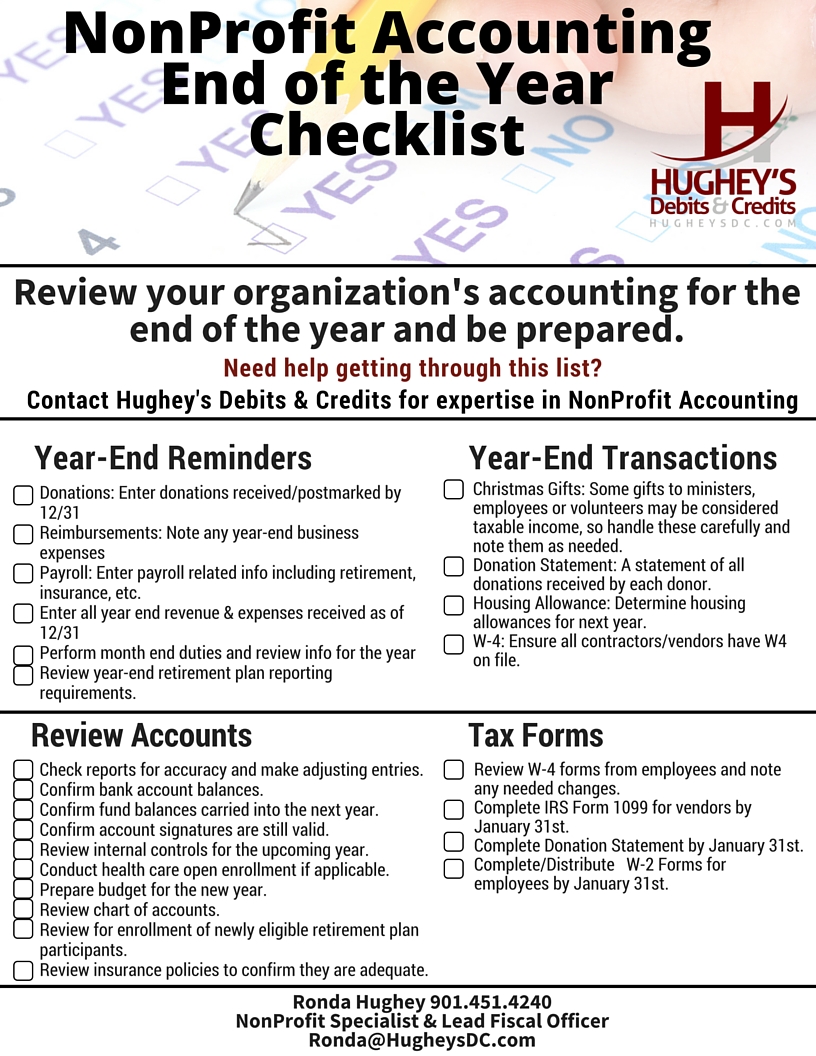

1099 W4 Hughey S Debits Credits

Answer We have created a quick infographic for the forms employers need for a 1099 employee These forms include a 1099MISC form, W9, and a written contract signed by both parties Question What is a 1099 employee rules?V55i Riparian plant communities fulfil many functions, including the provision of corridors linking protected areas and other zones of high conservation value For those of you that only need a reminder, I created a 2 Minute 1099 Checklist (Ok It is actually 2½ minutes, but I tried!) For those of you that are new to the process, see Terri's fulllength webinar in Online Resources!

Use Our Compliance Checklist To Minimize Contractor Risk Mbo Partners

Employee Versus Independent Contractor The Cpa Journal

1099 vs W2 Employee Checklist IRS RULES The IRS Checklist for 1099 vs W2 focuses on three main factors that provide evidence of the degree of control and independence 1 Behavioral Does the company control or have the right to control what the worker does and how the worker does his or her job?IRS Point Checklist How do you determine if a contractor should be paid on a W2 or a 1099?1099 Reporting Checklist Audience Labels sortorder3;

Accuservepayroll Com Wp Content Uploads 19 09 W 2 Vs 1099 Checklist Pdf

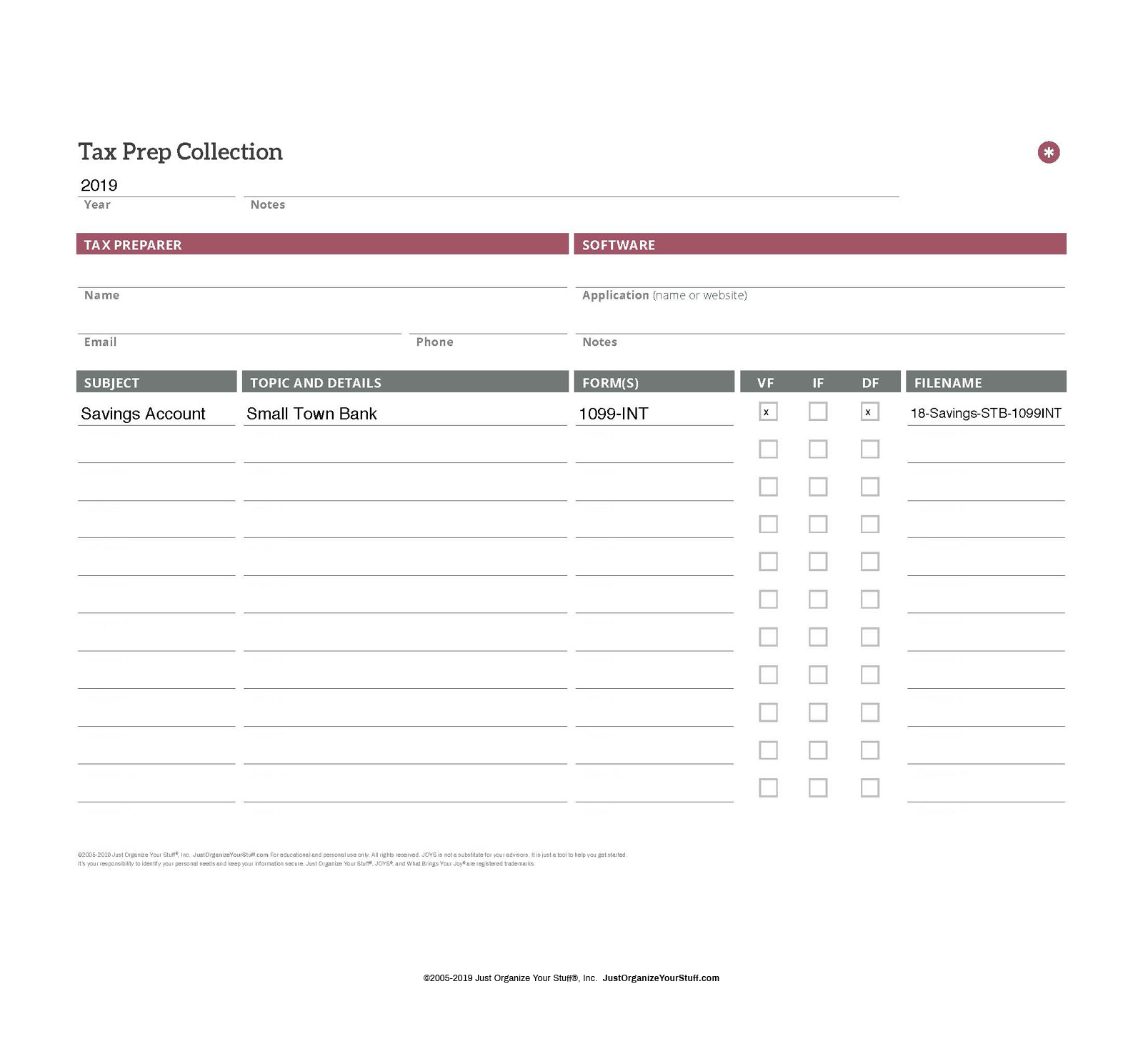

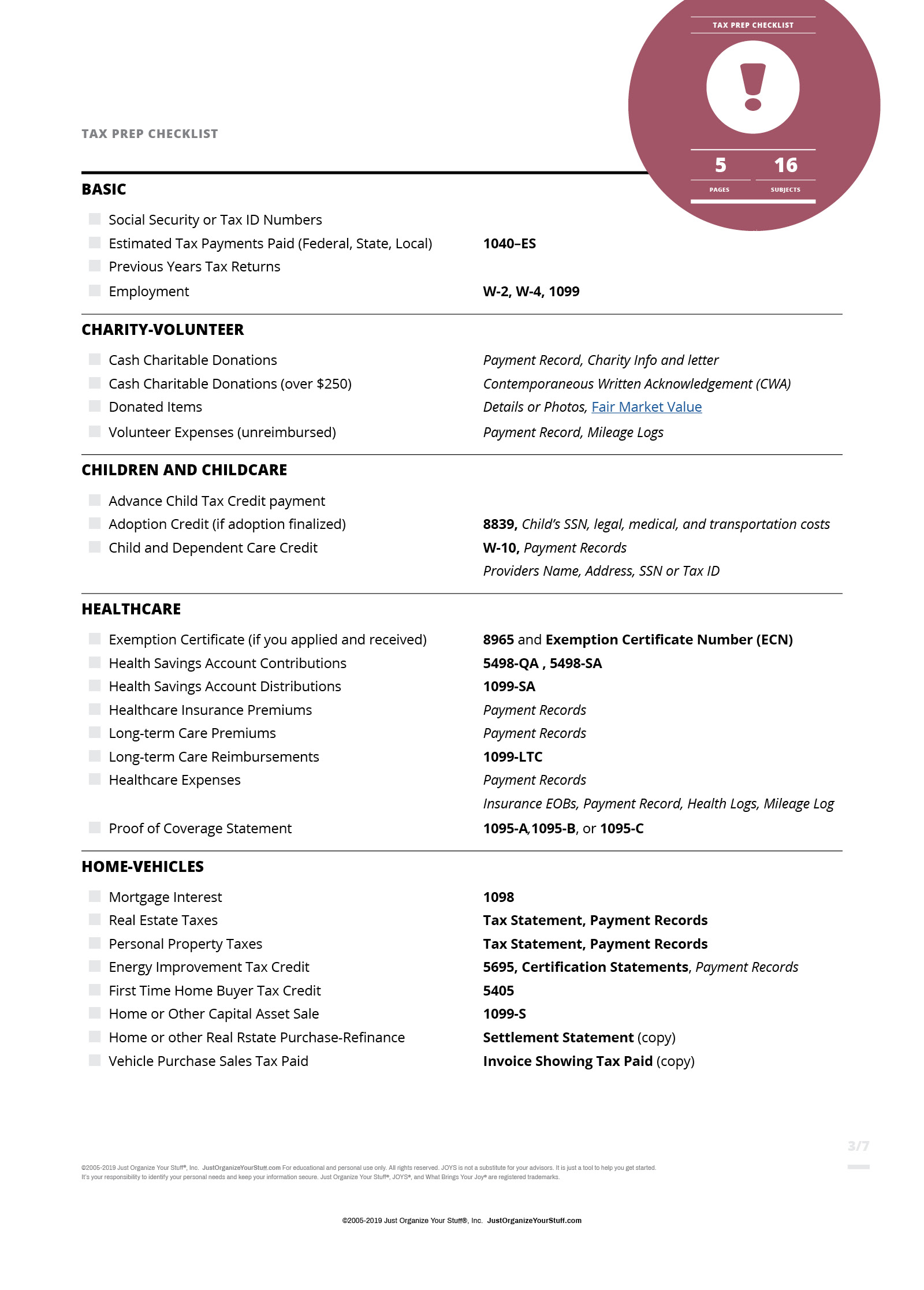

These 2 Tax Checklists Can Help Simplify Tax Prep Joys Just Organize Your Stuff

1099 Delegated Stacking Order Checklist Version 1 Verification of Mortgage/Rental history ☐ ☐ Proof of PITIA on all other Real Estate Owned (mortgage statements, tax bills, insurance, HOA) ☐ Fraud Report ☐ ☐ Income Underwriter's Bank Statement Worksheet ☐ ☐ Most recent 1 (or 2) of 1099s ☐ Verbal VOE (prior to closing) ☐ ☐ CPA letter (if applicableBe known about the filing method;En este artículo Applies To Microsoft Dynamics AX 12 R3, Microsoft Dynamics AX 12 R2, Microsoft Dynamics AX 12 Feature Pack, Microsoft Dynamics AX 12 Nota We recommend that you review IRS rule changes for the applicable tax year before you set up and process 1099

W2 Employee Versus 1099 Independent Contractor Compliance Checklist Liquid

Checklist W 2 Or 1099 Here S How To Decide Bluecrew Resources

Step 2 Fill out two 1099NEC forms (Copy A and B) Mark your calendar, because this form comes with a deadline In January, look at how much you've paid the independent contractor over the past year If you've paid them more than $600 within the past calendar year and their business entity is not an S corp or C corp, you'll need to file aAdministrative Assemble IRS publication and forms for the current 1099 reporting year Visit My Oracle Support to review Year End details in the JD Edwards World 1099, W2, and T4 Year End Updates for 19 document (Document ID XXXXXXX)Friday Features Leslie Bailey 1099, Video Comment Facebook 0 0 Likes Previous Finance Training in Ventura Customer Care, Finance,

Form 1099 Nec Excluded From Irs S Combined Filing Program Cfo Daily News

1099 Vs W2 Difference Between Independent Contractors Employees

Checklist For 1099 Tax Forms An Overview We have added all the essential tasks that enable a hasslefree tax filing process Further, if you are sure that the items don't apply to your business, then you may remove any of the items in this checklistChecklist for 1099Misc Just as important as a W2 is a 1099Misc 1099Misc need to filed by January 31 of every year just like W2s If a 1009 is not filed, the deduction may be disallowed and there may be penalties When does a 1099 need to be filed?Unemployment (1099G) SelfEmployed Forms 1099, Schedules K1, income records to verify amounts not reported on 1099MISC or new 1099NEC Records of all expenses — check registers or credit card statements, and receipts Businessuse asset information (cost, date placed in service, etc) for depreciation Office in home information, if applicable

Filing Cryptocurrency Taxes Get Started With This Checklist Taxbit Blog

Checklist For Tax Preparation Appointment Do Taxes

1099 Checklist 0 Comments Part I – Setup Procedures for 1099 Vendors 1099 forms are submitted to the IRS by companies such as yours to report money earned by individuals that has been paid on an untaxed basis It is the responsibility of the individual to file and pay the appropriate taxes The first 4 steps should be done at the beginning of the (USA) Form 1099 checklist Applies To Microsoft Dynamics AX 12 R3, Microsoft Dynamics AX 12 R2, Microsoft Dynamics AX 12 Feature Pack, Microsoft Dynamics AX 12 !NOTE We recommend that you review IRS rule changes for the applicable tax year before you set up and process 1099 statements These controls are available only to legal entities whose A 1099 vendor is a designation listed in each of the records in the vendor master file that is part of an accounting software package If you designate a supplier as a 1099 vendor, the system will print a Form 1099 for the supplier as part of the 1099 batch processing that follows the end of the calendar year

How To Onboard A 1099 Employee

Financial Tip Of The Month Tax Prep Checklist Tax Prep Checklist Tax Prep Business Tax

1099 Employee Checklist (FAQ Style) Question What form(s) do you give a 1099 employee?W2 Employee versus 1099 Independent Contractor Checklist It's not easy to determine whether someone is an employee or an independent contractor Our employee versus independent contractor checklist makes it simple to navigate the difference We help you activate the liquid workforce, adding value to your team of fulltime employeesUse this checklist to guide you through preparing your Year End Payroll & AP 1099 information This section has information about which payroll reports to run and how to process your Federal and State forms including the W2/W3, 940, 941, and 1099/1096 forms

Employee Versus Independent Contractor The Cpa Journal

Www1 Villanova Edu Content Dam Villanova Hr Documents Taxpayer Checklist Pdf

1099 Checklist 17 Page 6 REMINDER If the Student Activity check transactions are not maintained in TxEIS, you will need to manually enter information on any vendors involved with transactions that require a 1099, in the 1099 Record Maintenance screen _____8 Print 1099 MISC forms Once all information has been verified, the actual 1099 In the Legal entities form, enter 1099 data In the 1099 fields form, verify the minimum amounts that are required for 1099 reporting for the current tax year In the Vendors form, enter information in the 1099 fields for each vendor that will receive a 1099 statement Click Set up > Vendor state tax IDs, and then enter all state 1099 information (USA) Form 1099 checklist ;

Keeping Your Year End Payroll On Track Printable Checklist Walz

How To File Taxes The Easy And Organized Way Tax Prep Checklist Tax Checklist Filing Taxes

A Checklist for 1099 Processing Use the following checklist as a guideline for processing your 1099 returns Type Tasks Completed;Make sure to provide employee/payee copies on time;Internal Revenue Service point Checklist for Independent Contractor Mistakenly classifying an employee as an independent contractor can result in significant fines and penalties There are factors used by the IRS to determine whether you have enough control over a worker to be an employer Though these rules are intended only as a guidethe IRS says the importance of each

Tax Preparation Checklist A Bowl Full Of Lemons

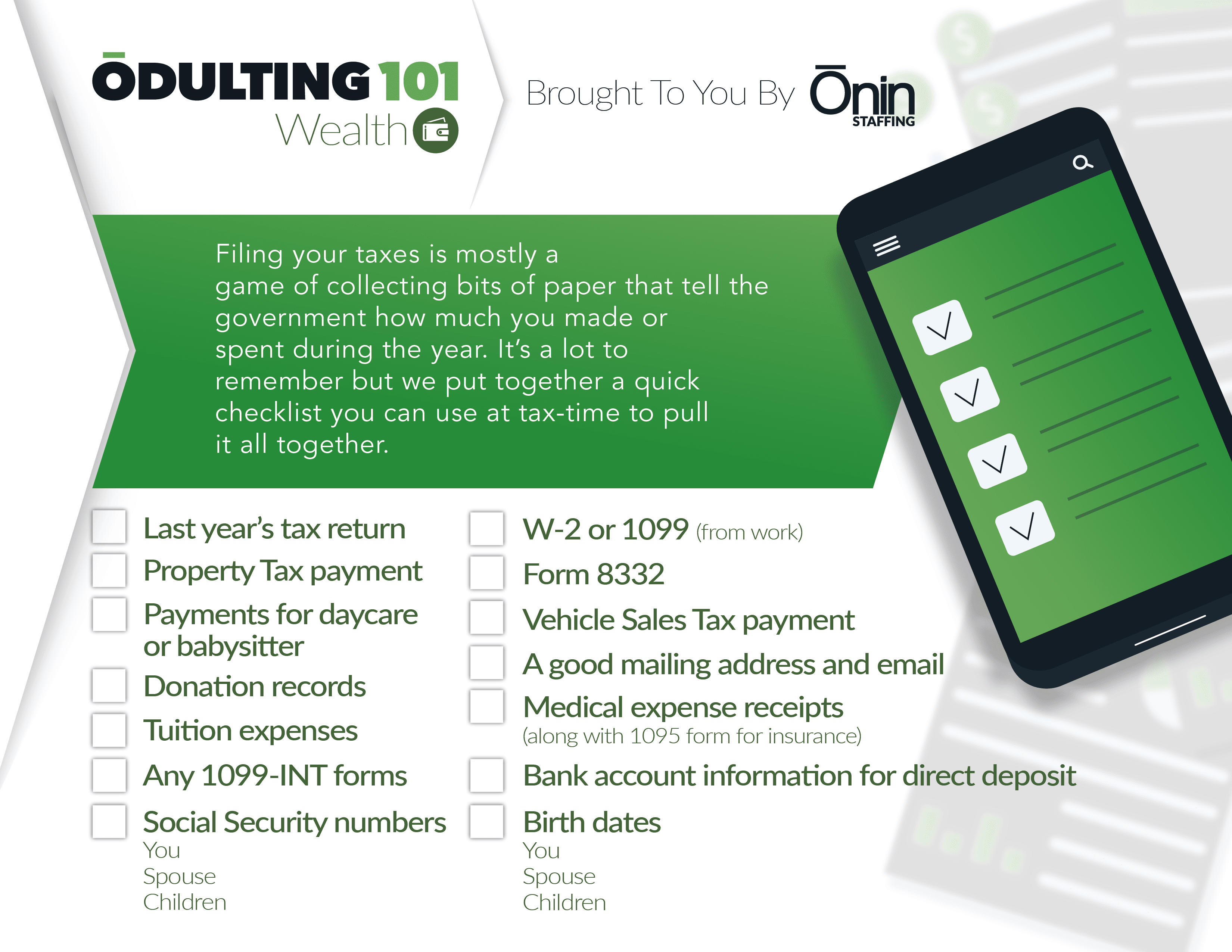

ōdulting 101 Taxes ōnin Staffing

Check the information furnished before filing;Always crosscheck the TIN you have entered; 19 1099 YearEnd Checklist 0 Comments Hello and Happy !

These 2 Tax Checklists Can Help Simplify Tax Prep Joys Just Organize Your Stuff

Offboarding Checklist Clicktime

Here's a checklist to help you avoid W2/1099 penalties Be aware of the deadlines and do your filings on time; Note that filing a 1099 and a W2 for the same worker could result in a tax audit The IRS will perform such audits on employers if they suspect someone has misclassified an employee The tax differences between W2s and 1099s Your tax obligations vary between 1099 contractors and W2 employees You pay 1099 workers per the terms of theirPrint 1099 Quick Checklist 1099 (Extended) TIN Verification File 1099/W2 Indicator For those of you that just need a reminder of what to do and where to go, we have created the following checklist Get Ready Task Notes;

The 1099 Decoded The What Who Why How 1099s Bookkeeping Business Business Management Degree Small Business Accounting

Independent Contractor Taxes Guide 21

DPN 1099s Preliminary Checklist DPN 1099 preliminary check list and changes for year end • Knowledge Information Description Beginning with Tax Year , the IRS requires the use of Form 1099NEC, Nonemployee Compensation, to report payments of nonemployee compensation (NEC) previously reported in box 7 on Form 1099MISC ThereThe 1099 form is a series of documents the Internal Revenue Service (IRS) refers to as "information returns" There are a number of different 1099 forms that report the various types of income you may receive throughout the year other than the salary your employer pays you The person or entity that pays you is responsible for filling out the appropriate 1099 tax form and1099_letter_pdf File Size 107 kb File Type pdf Download File We Would Love to Have You Visit Soon!

2

1

Per the IRS, however, the most commonly used information return is the 1099MISC Companies may want to establish a 1099 checklist to help decide whether it is necessary to issue a 1099–MISC form at yearend Did You Make Payments to Independent Contractors? If you're using a 1099 employee, you will first want to create a written contract If you pay them $600 or more over the course of a year, you will need to file a 1099MISC with the IRS and send a copy to your contractor If you need help with employee classification or filing the appropriate paperwork, post your need in UpCounsel's marketplace24 Checklist for 1099 Processing For processing 1099 returns, use the following list as guidelines 1099 A/P Ledger method 1099 G/L method Combined A/P Ledger and G/L methods 1099 Returns for All 1099 methods 241 Optional Update yeartodate (YTD) voucher amounts by using the Update YTD Voucher Amount program (R040A) Typically, you update YTD voucher

1

As the calendar year has now ended, it is time to get prepared to process your 19 1099 Forms If you click on the link below, there is a 1099 Checklist that should assist you with any yearend questions that you might have Please review the steps prior to running 1099s DOWNLOAD THE COMPLETE YEAREND CHECKLISTHere is a check list for reporting on 1099Misc 1 Was a service provided in the course of a trade or business?1099 Checklist Updated December 18 Page 7 of 11 REMINDER If the Student Activity check transactions are not maintained in TxEIS, you will need to manually enter information on any vendors involved with transactions that require a 1099, in the 1099 Record Maintenance screen _____8 Print 1099 MISC forms Once all information has been verified, the actual 1099 MISC Form can

Www Fabtaxteam Com 2367lina 1clientprep Checklist Pdf

2

The 1099 form covers payments you receive that may potentially be taxable in a calendar year It is a series of information filing form that the IRS refers to as "information returns" Here is a list of the most common questions from 1099 workers about filing taxes for their miscellaneous income Why is a 1099 so important in the US tax system?

1099 Sample Forms

19 1099 Year End Checklist Queue Associates

1

Http Www Cpalaramie Com Cpalaram Files 15 entity engagement packet Pdf

What Is Form 1099 Misc When Do I Need To File A 1099 Misc Gusto

Tax Preparation Checklist By Mdconceptsllc Issuu

Tax Preparation Checklist For First Timers Canon Educational Articles

Due Diligence Checklist Sample Only

2

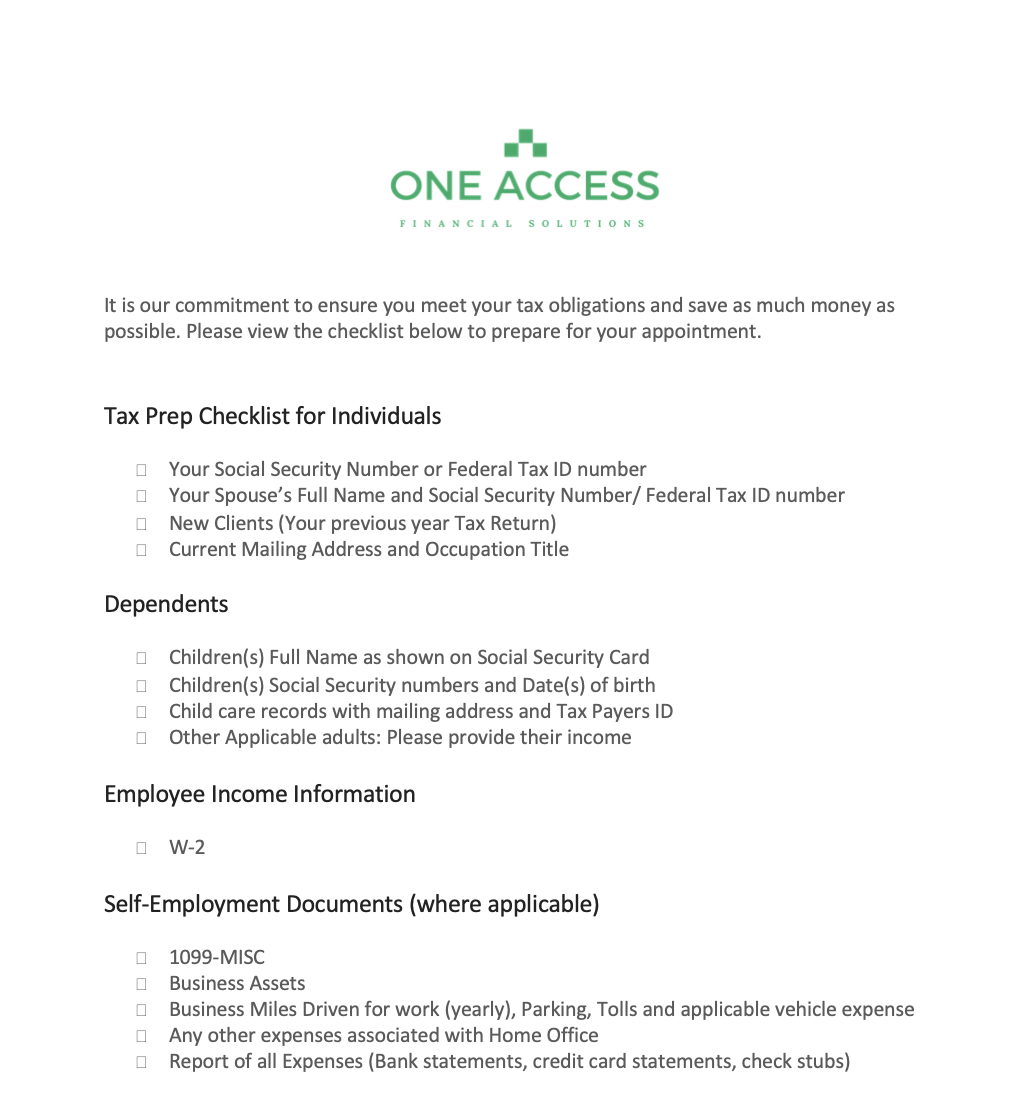

Business Tax Prep One Access Financial Solutions

1099 Vs W2 Difference Between Independent Contractors Employees

Vendors Reports Overview Support Center

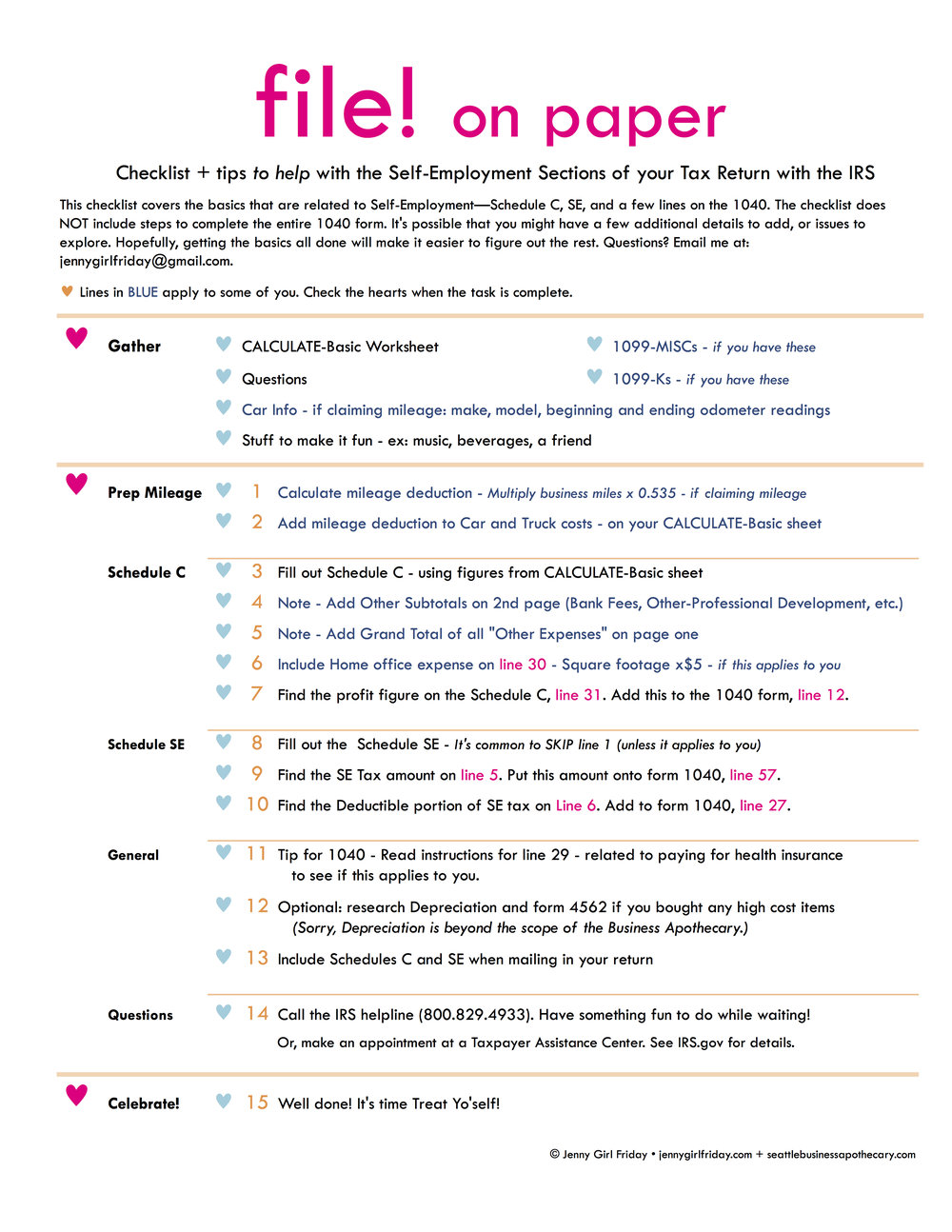

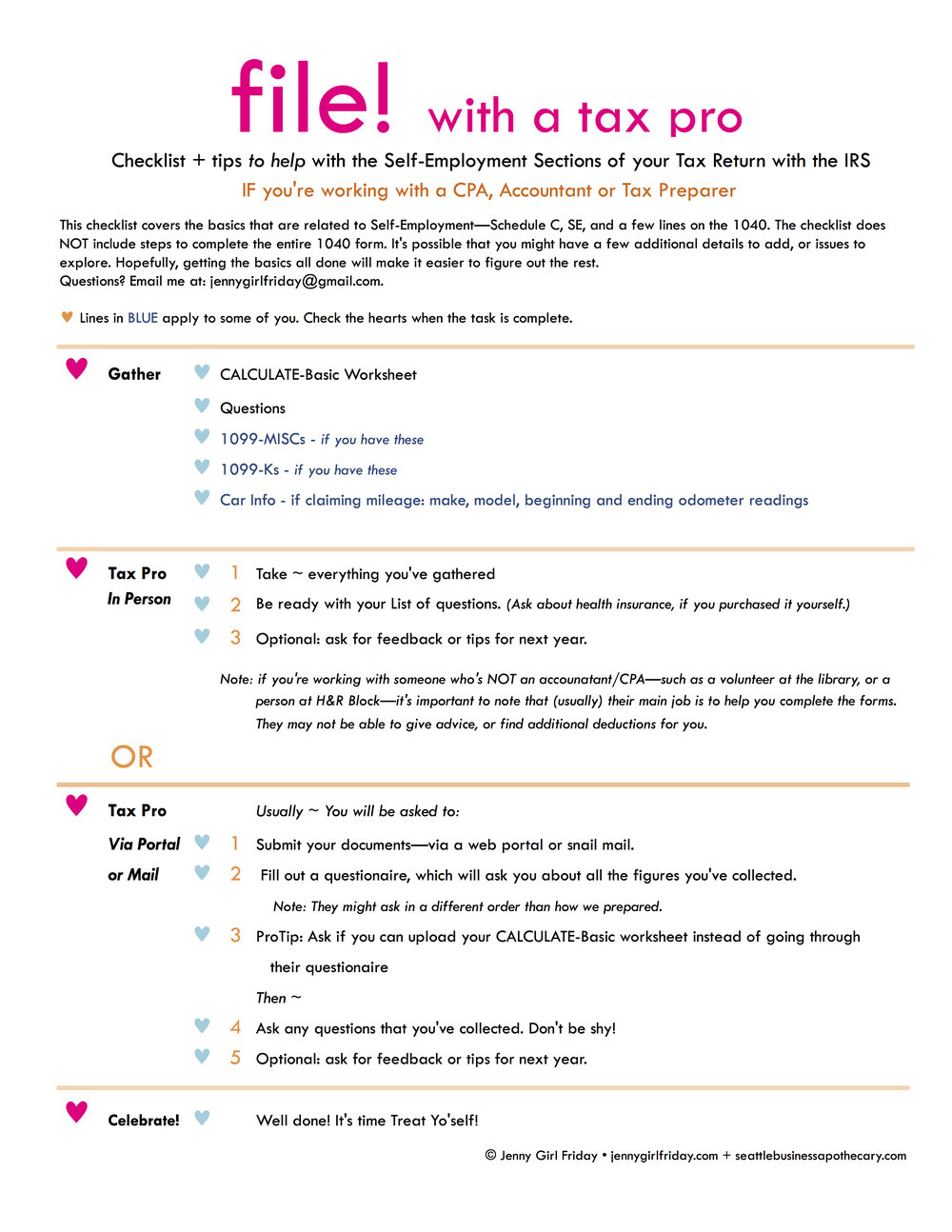

1099 Misc Irs Tax Prep Seattle Business Apothecary Resource Center For Self Employed Women

19 1099 Year End Checklist Queue Associates

2

2

The Amazing 1099 Checklist For Independent Contractors

2

Galachoruses Org Sites Default Files Irs Questions W2 Vs 1099 Pdf

Secure Emochila Com Swserve Siteassets Site126 Files Tax Preparation Checklist Pdf

1099 Tax Prep Checklist For Wonolo Workers Wonolo

1

Performing 1099 Year End Reporting

Lucybookercpa Com Files Tax Organizer Checklist Pdf

Tkitax Com Files Logo Final Form Income Tax Checklist Pdf

Tax Season 21 Checklist For Tax Professionals

1099 Misc Irs Tax Prep Seattle Business Apothecary Resource Center For Self Employed Women

Your Last Minute Checklist For W2 1099 Filing Blog Expressefile Create Fillable Form W2 1099 Misc 941 2290

19 1099 Year End Checklist Queue Associates

Jl Financial Services American Tax Service Lorain Country Tax Service

2

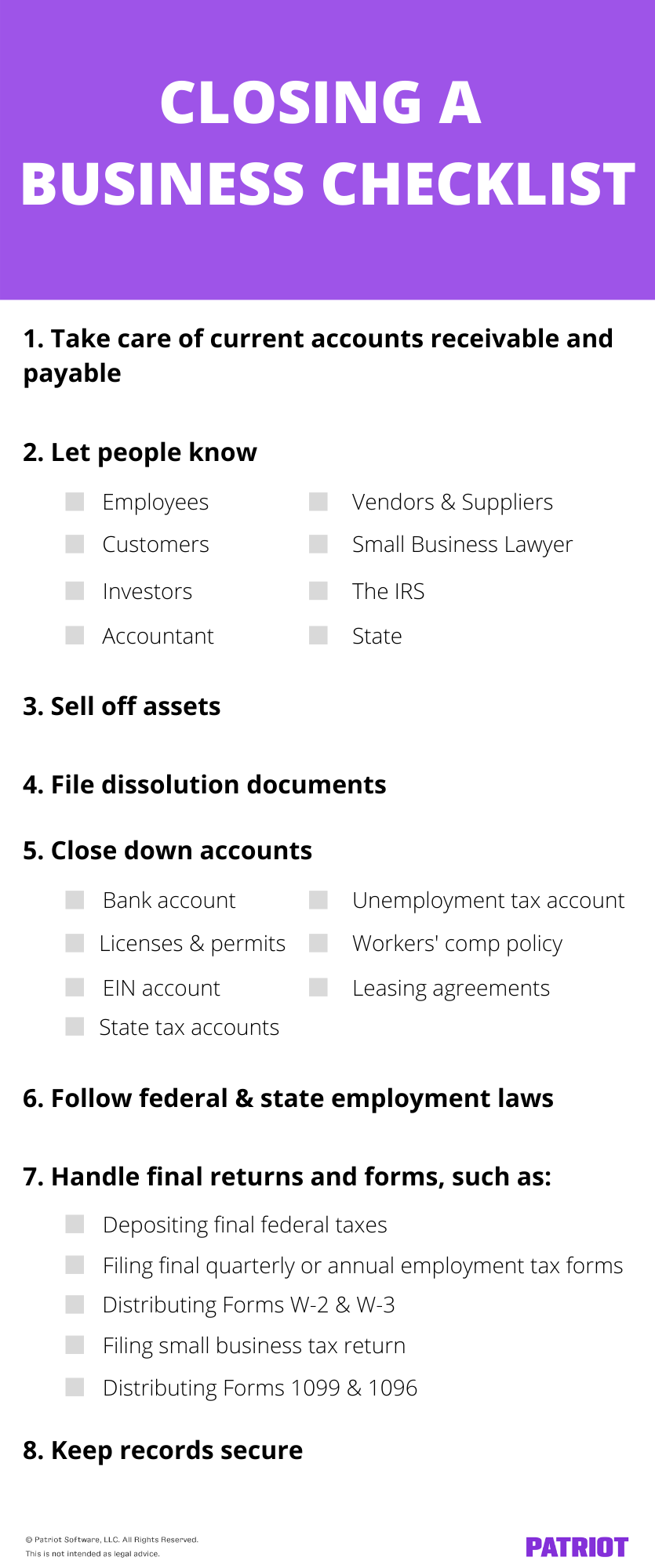

Closing A Business Checklist Patriot Software

Year End Checklist 1099 Filings

19 1099 Year End Checklist Queue Associates

Home Army Mil Knox Index Php Download File View 738 727

Danbury Vita Org S Tax Preparation Checklist Ty 3xwx Pdf

Understanding The 1099 K Gusto

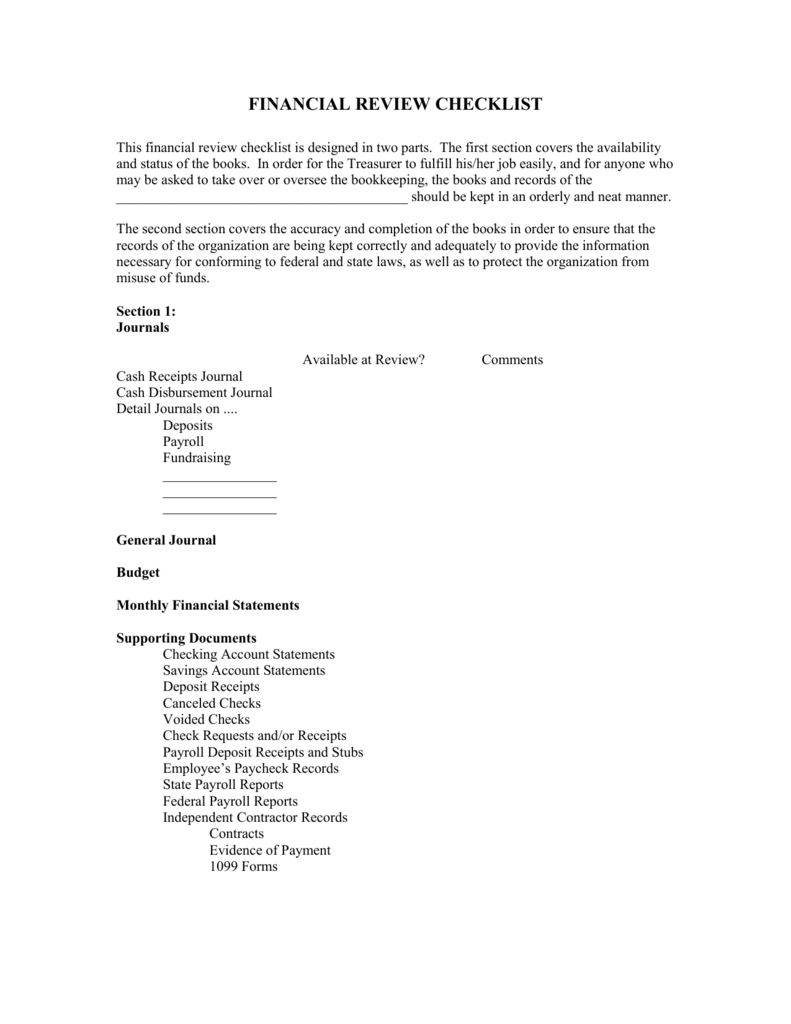

Financial Review Checklist For Internal Audits

2

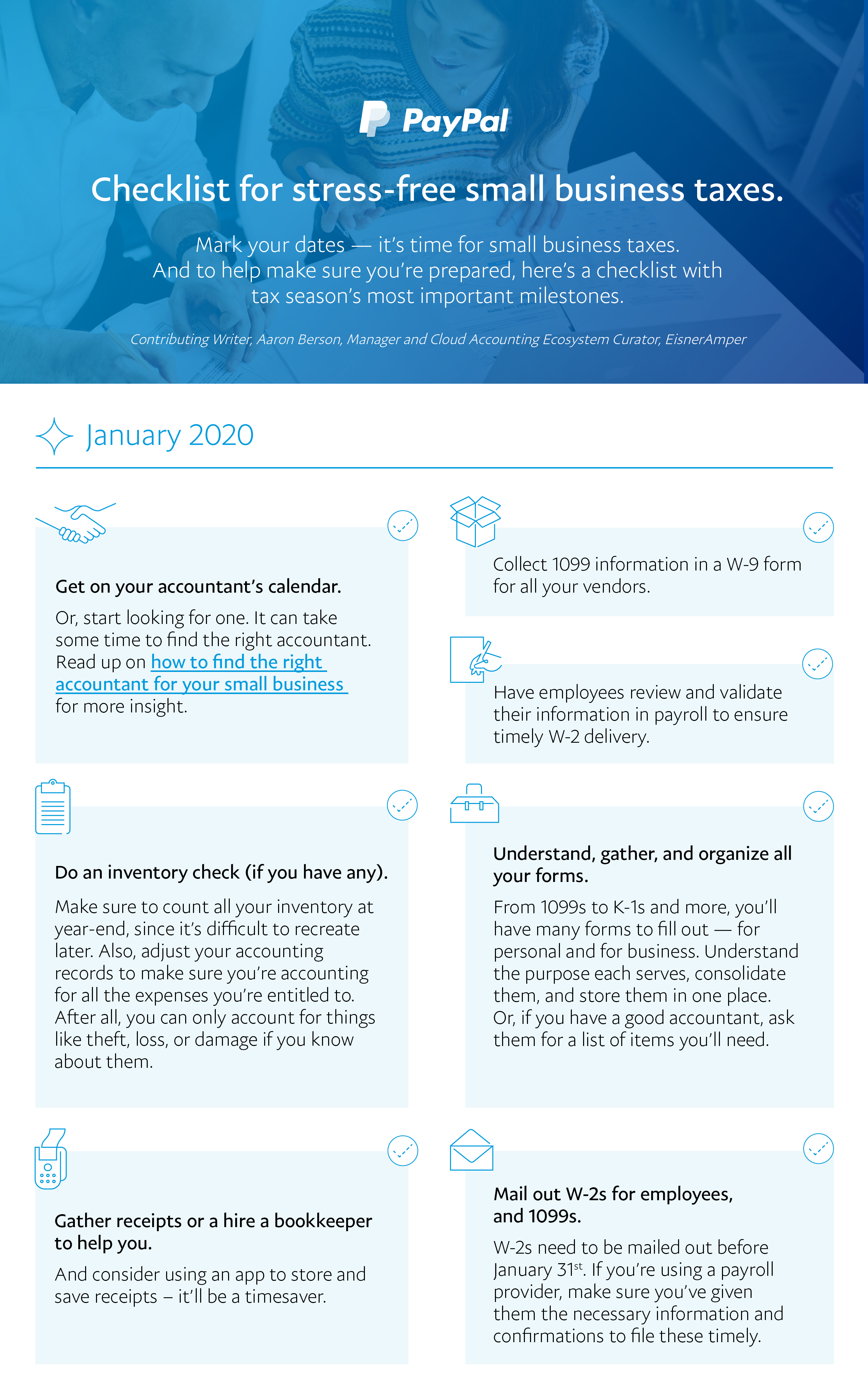

Checklist For Stress Free Small Business Taxes

Tax Prep Checklist For 18 Shoff Accounting

Digitalasset Intuit Com Document 4724mxi Turbotax Taxprepchecklist Pdf

Ready For The Tax Season Here Is Your 21 Tax Checklist Secret For Money

Independent Contractor Vs Employee Classification With Infographic

The Documents You Need Before You File Your Taxes Home Of The Credit Cleanup Newsletter

2

Www Evolutiontaxcenter Com Wp Content Uploads 21 02 W2 Or 1099 Tax Checklist Pdf

Tax Checklist Ramseysolutions Com

2

Www Hensleyandthroneberry Com Wp Content Uploads 17 03 Tax Prep Checklist Pdf

Year End Bookkeeping Checklist For Small Businesses Tower Books

How To Reconcile Your Etsy 1099 To Your Bookkeeping Profit Loss Report Small Business Sarah

Tax Preparation Checklist Wicks Emmett Cpa Firm

What Do You Need To File Your Taxes Income Tax Checklist For Your 1040 Tax Return Youtube

2

Did You Buy A New Home In 16 This Tax Preparation Checklist Can Help You Get Organized Dickerson Nieman Real Estate Blog

2

Www Cspcpa Com Wp Content Uploads 15 12 Small Business Tax Prep Checklist Pdf

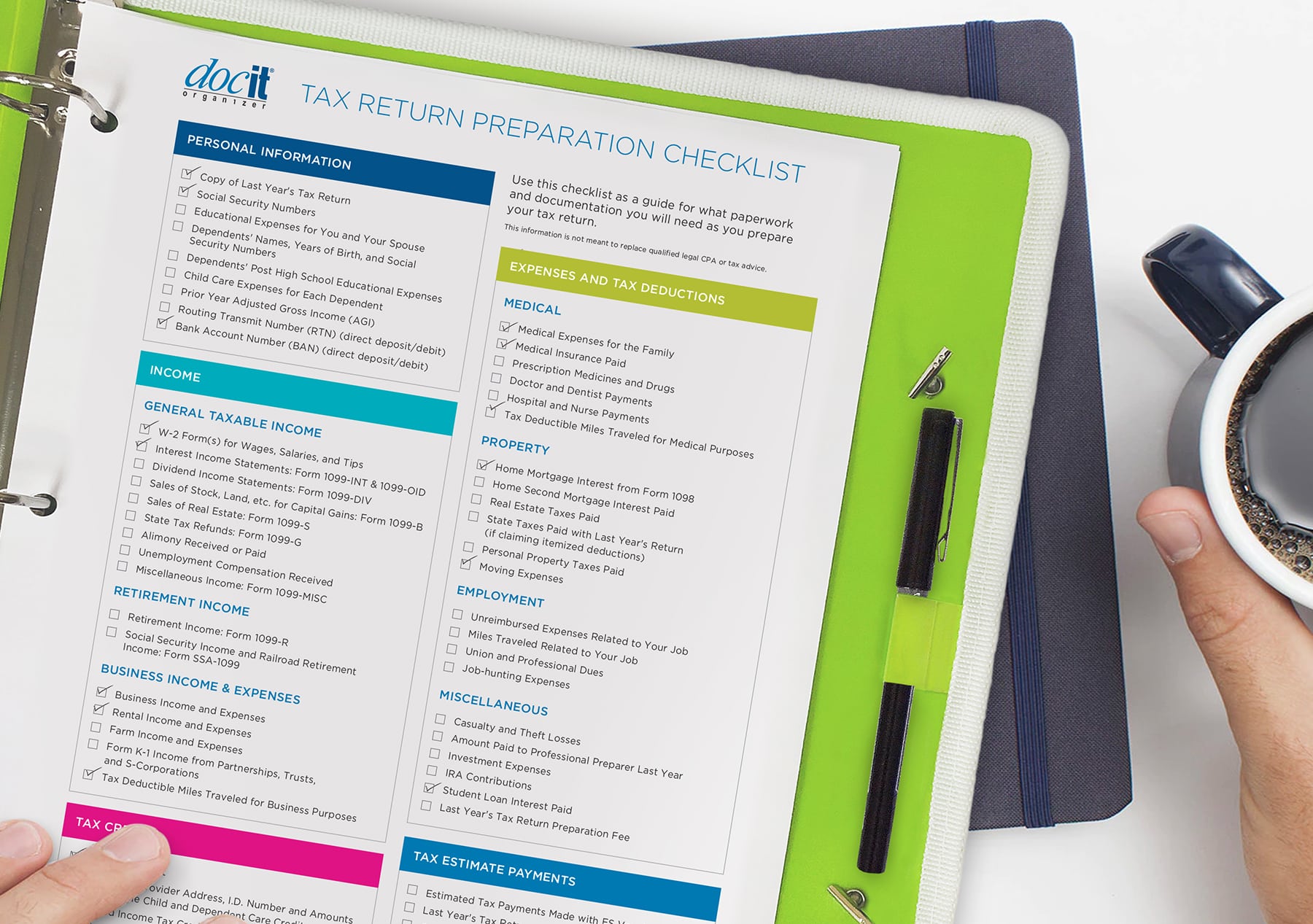

Docit Tax Return Prep Checklist Paris Corporation

End Of Year Checklist Accountingprose

Your Hsa And Your Tax Return 4 Tips For Filing Wex Inc

Small Business Tax Preparation Checklist 21 Quickbooks

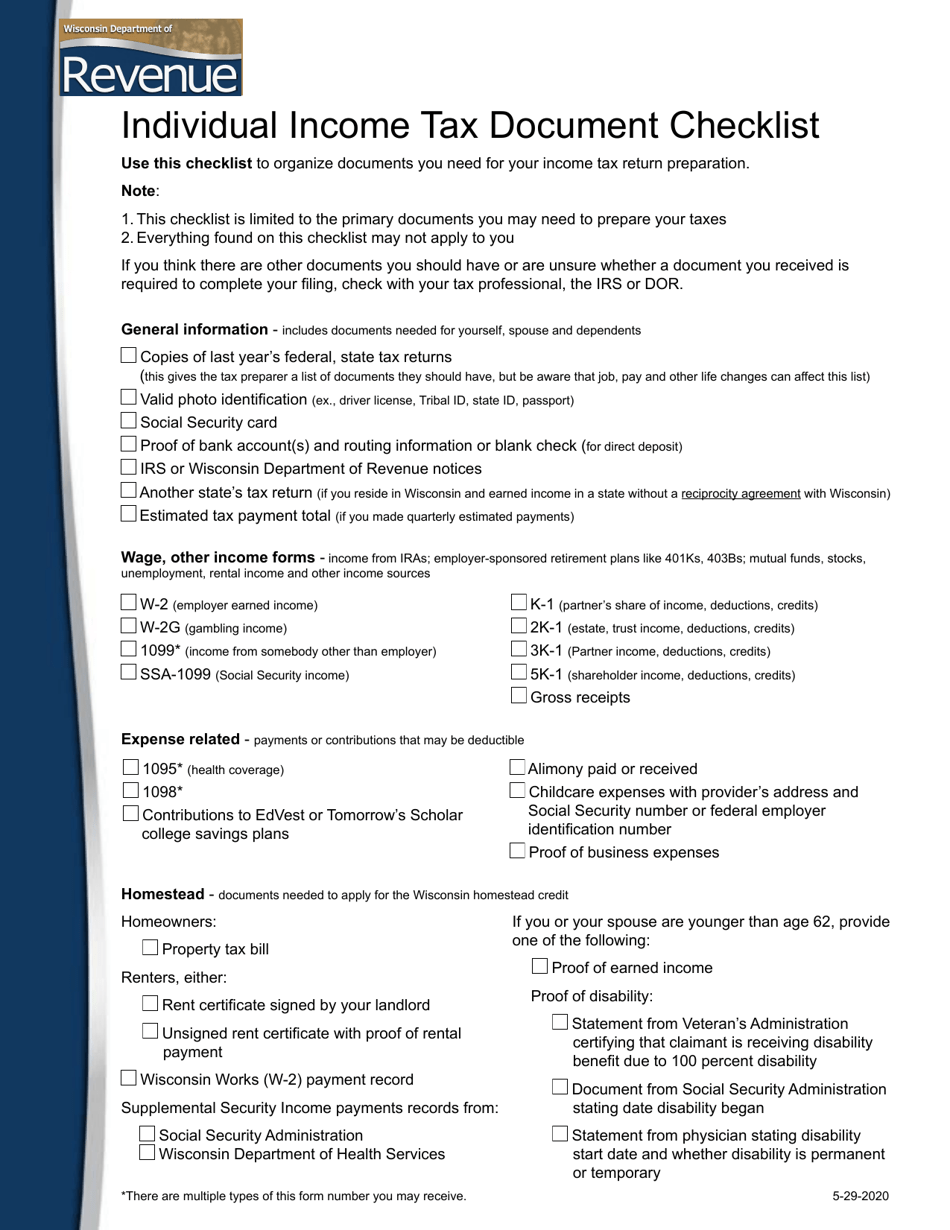

Wisconsin Individual Income Tax Document Checklist Download Fillable Pdf Templateroller

1099 Vs W2 How 4 Different Agencies View Independent Contractor Relationships Infographic Employers Resource

2

The Tax Preparation Checklist Your Accountant Wants You To Use Tax Prep Checklist Tax Prep Tax Preparation

/documents-when-hiring-a-contract-worker-398608_final-c7b9e3e0f1704d388f723fe60239b079.png)

3 Documents You Need When Hiring A Contract Worker

19 1099 Year End Checklist Queue Associates

2

Do You Need To Issue A 1099 To Your Vendors Accountingprose

0 件のコメント:

コメントを投稿